Loading... Please wait...

Loading... Please wait...- Home

- Buy

- Subscribe to DLSUB

-

Info

- DLSUB Match or Beat Any Verified Price

- DLSUB Deliver Here is the Proof

- DLSUB Members Download Every Course in the DLSUB VAULT for Free

- Why DLSUB GOLD ELITE Annual Membership is a No Brainer

- Unlock DLSUB 365K Worth of Learning For Just a Dollar a Day

- DLSUB Members Only Pay $1.49 Per Course

- DLSUB Lifetime Subscription

- Not a DLSUB Member No Problem

- DLSUB Members Get 30 Premium Trading Courses for Just $245

- How DLSUB works

- What Does DLSUB Stand For

- DLSUB Rewards

- DLSUB Dropping Soon

- DLSUB LIFETIME

- DLSUB Refund Policy

- Contact DLSUB

- Sitemap

📩 For Download Links → Email: admin@pdc4s.com

Pristine - Trading the Pristine Method 2

Retail Price: $1995

Your Price:

DLSUB Member Price: $0

Pristine - Trading the Pristine Method 2

Pristine - Trading the Pristine Method 2

Pristine - Trading the Pristine Method 2

Pristine - Trading the Pristine Method 2

Course Overview

Pristine - Trading the Pristine Method 2 is an intermediate to advanced trading course taught by Paul Lange, designed to elevate your price action skills with a systematic framework for entries, risk control, and trade management. Building on the original Pristine Method, TPM 2 dives into pivots, gaps, candlesticks, support and resistance, multi time frame alignment, bar by bar reading, and relative strength so you can execute with clarity and confidence across intraday and swing time horizons.

Expert Guidance You Can Trust

Paul Lange brings a clear, structured teaching style that turns complex market behavior into practical, rules based action. Expect seasoned insights on price action, support and resistance, and risk management so you can apply Pristine Buy and Sell Setups with precision and consistency in real market conditions.

Core Concepts and Principles

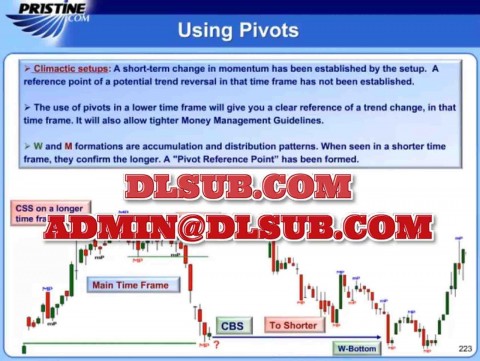

✔️ Pivots, trend change recognition, and high quality confirmation signals

✔️ Gap taxonomy and tactics: professional, novice, and exhaustion gaps

✔️ Candlestick context, congestion of candles, and decision zones

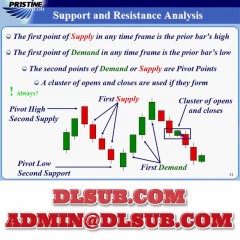

✔️ Support and resistance mapping for timing and risk placement

✔️ Multi time frame alignment for entry confidence and trade management

✔️ Bar by bar analysis and market internals as execution filters

✔️ Position sizing, risk control, and expectancy driven decision making

What You Will Gain

✅ A complete Pristine Method playbook tailored for modern markets

✅ Repeatable entry criteria for Pristine Buy and Sell Setups

✅ A step by step process for managing gaps at the open

✅ Robust risk rules, stop logic, and sizing templates

✅ Practical bar by bar timing techniques to reduce hesitation

✅ Confidence from real chart case studies and walk throughs

✅ Skills that transfer across intraday, swing, and prop environments

Content Outline

☑️ Pivots and trend change plus gap analysis for the open

☑️ Candlestick confirmation, support and resistance, Pristine Sell Setup, and COG

☑️ Advanced support and resistance plus Pristine Buy Setup

☑️ Moving averages for structure and volume as confirmation and warning

☑️ Volume across time frames and healthy vs failed retracements

☑️ Retracement depth, W patterns, and reversal confirmation

☑️ Bar by bar timing and market internals for decision support

☑️ Relative strength, trend quality, and conviction building

☑️ Pivots and gaps revisited with real chart dynamics

☑️ Failed patterns, multi time frame confirmation, and recovery

☑️ Money management, sizing, and final market review integration

Real Student Feedback

✨ "TPM 2 gave me a rules based structure that finally made my entries consistent."

✨ "The gap section changed how I trade the open and improved my risk control."

✨ "Bar by bar training removed hesitation and sharpened my timing."

✨ "Support and resistance mapping plus COG made my planning far clearer."

Strategy in Practice

➡️ A swing trader cut average loss in half by applying strict stop logic around true pivot breaks.

➡️ A prop candidate improved expectancy using multi time frame confirmation before each entry.

➡️ An intraday trader increased win rate on gap trades by classifying gaps and adjusting tactics at the open.

Unlock Your Full Trading Potential

✔️ Master a proven framework that clarifies what to trade, when to act, and how to manage risk.

✔️ Build confidence with price action skills that hold up through changing market regimes.

✔️ Seats are limited - secure access and level up your execution with TPM 2.

Your Questions Answered

❓ Is TPM 2 right if I already know basic technical analysis?

✔️ Yes. It is designed for intermediate to advanced traders who want a deeper, structured approach to execution and risk.

❓ Does the course cover both intraday and swing trading?

✔️ Yes. The methods apply across time frames with clear guidance on alignment and risk parameters.

❓ Will I learn how to trade gaps at the open?

✔️ You will learn a gap taxonomy and actionable tactics for professional, novice, and exhaustion gaps.

❓ Is there a focus on bar by bar timing?

✔️ Absolutely. Bar by bar analysis and market internals are core execution tools in TPM 2.

❓ How does TPM 2 improve consistency?

✔️ By combining precise entries, defined stops, and sizing rules into a single, repeatable process.

Related Trading Courses